Equita Financial Network provides a powerful community of support + a turnkey platform for women-led, independently operated, fee-only financial planning firms.

Equita is a SEC Registered Investment Advisor, that allows Member firms to conduct business as a DBA, thereby avoiding the need for Member firms to register either with the State or SEC.

Equita provides a turnkey platform that includes all the necessary resources to run a comprehensive financial planning firm, as well as investment management services.

Equita does not take an equity stake in any Member firm. Member firms maintain their own independent, autonomous brand. You own your client relationships – always.

The Equita platform is intentionally priced so that women business owners can keep more of what they make.

Equita provides a robust and structured community to support collaboration across Members, sharing of best practices, and client solutions + advocacy, education, and succession planning options.

In-person and virtual gatherings support the exchange of information and ideas between like-minded professionals who share freely and support one another.

Having an abundance mentality is an essential element of success when you become a part of the Equita community.

Equita also provides the opportunity to uncover potential partners for emergency continuity planning and/or succession planning purposes.

Member firms are CERTIFIED FINANCIAL PLANNER™ Professionals or will commit to earning the designation.

JOIN THE EQUITA FINANCIAL NETWORK

Equita Financial Network offers a remarkable opportunity for women in the financial advisory world to be a part of the ever-expanding EFN Community!

Membership is open to passionate and forward-thinking fee-only CFP® women in the profession.

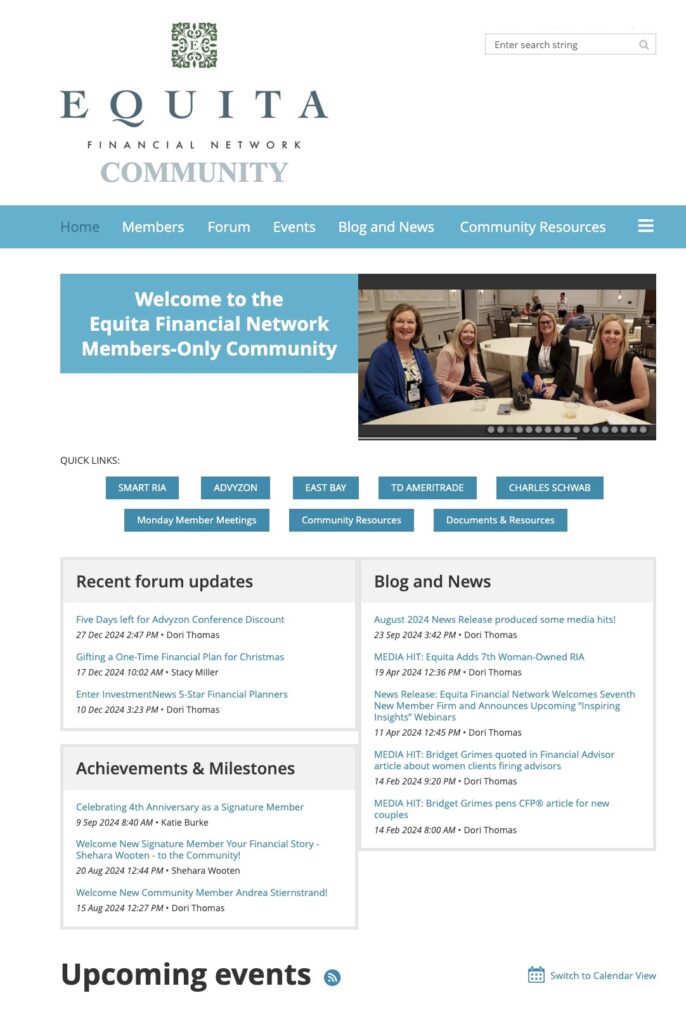

You will gain exclusive access to a vibrant community where knowledge and ideas flow freely, fostering a sense of camaraderie and support among like-minded financial advisor professionals.

Join us at the membership level that is right for you!

MEMBERSHIP LEVELS:

Community Membership

$39 monthly – Billed 6 months in advance, no refunds

As a valued Equita Community member, you’ll receive:

- Access to the robust online members-only Equita Community platform

- Automatic registration and complimentary attendance to our educational webinar series, “Inspiring Insights,” completely free of cost (normally $39 per webinar for non-members) – this is an invaluable resource for staying ahead in this dynamic industry. Many webinars qualify for CFP® and NAPFA Continuing Education credits.

- Weekly Virtual Member Meetings and Mastermind Groups, along with a plethora of other exciting network events.

Signature Platform Membership

$1,500 per month for fixed platform costs charged quarterly in advance, plus 15 basis points of AUA for variable platform costs – this pricing and variable solution works best for firms with $20M AUA or greater.

As a valued Equita Signature Platform member, you’ll receive everything at the Community Membership level, plus:

- Centralized Firm Technology Hub – Performance reporting, customizable client portal, CRM, and streamlined billing through Advyzon

- IT Solution – 24/7 Tech Support through San Diego Computer Consulting

- Financial Planning Software – Subscription through eMoney Advisor

- Comprehensive Insurance Coverage – E&O, Cyber Liability, and Wire Fraud Coverage with Box Professional Insurance through Markel

- Ongoing Compliance Support – Includes marketing, blog, and advertising review, all registration documents and requirements through Financial Planners Assistance Corp

- Client Invoicing – provided by Rhea Bookkeeping

- Annual Scholarship for CFP® designation

- Investment solutions and practice management support – Access through Dimensional Fund Advisors (DFA) and many others.

- Custodial Relationship with Charles Schwab & Co Inc. and TIAA

- Collaboration – Community discussion board with document sharing capabilities + ongoing virtual and in-person meetings with a nationwide network of entrepreneurial, financial planning peers and strategic partners through The Equita Member Platform and Slack

- Listed on the Equita Find An Advisor directory

Outsourced CIO – East Bay Investment Solutions provides client transition planning, investment solutions, and portfolio management resources, as well as customized investment models.

- Portfolio Solutions**

- Proprietary Equita Models and dedicated trading team with Advisor Logistics

- Schwab iRebal for Advisor as Portfolio Manager

- Advyzon Investment Management, LLC (AIM) portfolio solutions and trading team

*AUA is defined as any assets under advisement.

**Portfolio solutions vary in pricing from 5bps to 20bps and are in addition to the quarterly AUA fee.

It’s time to take your business to the next level.

If you are driven, ambitious, and eager to connect with the best in the field, complete our application and embark on a transformative journey as an Equita Community Member or Signature Platform Member today.

Together, let’s redefine success for women in the world of finance!

Interested in joining our thriving Community?

Seriously, aren’t you impressed?