The secret to maximizing energy, time, and productivity. 4th in a Series | Part 1, Part 2, Part 3

By Colleen Jordan Hallinan, Qii Consulting

Strategic and Tactical. You know the difference, right?

Strategic is thoughtful, it’s high level, it’s directed, intentional, and it’s what helps you pursue what you want.

Tactical is practical, it’s action steps, boots on the ground, and it’s how you get you want.

We’re pretty much clear on this difference, yet sometimes it’s easy to find ourselves lost in the complexity, buried in projects, stressed out and wondering (not out loud, of course) “what do I do next?” or “where am I, and what am I doing with this [business/career/job]?” or burned out and not sure why.

Know What you Want and Need

When you find yourself lost in this or some similar morass, ask yourself, “Am I driving my business? Or is my business driving me?”

If it’s the latter, know you are in good company. This is quite common for ambitious, high-achievers who’re action-oriented, exposed to a lot of opportunities, surrounded by other high-achievers, and often riding on momentum.

So, how did you get here?

- You may have tacked adrift and are no longer on the course you set out on. Or, you’ve had an epiphany, evolved your thinking, or adopted a new mindset, and your original destination or objective doesn’t fit this new frame of mind.

or

- You made a business plan, but you never really took seriously the idea that the business is simply a component in your very full life, and you didn’t start the strategic process by figuring out what you really want and need for yourself and that the business is only a tool for achieving THAT.

In either case, sit back, take a deep breath and make the time – squeeze it in – cancel other commitments if you have to, this is really important, make the time to go about this in the proper order:

- In my life, what outcomes do I personally want and need for myself to feel happy, fulfilled, grounded and confident in my future? Figure this out before you focus on others and the business as we’ll discuss below.

- What action steps do I need to take to achieve these outcomes?

- What time and resources will I need to take the necessary actions?

- Then, and only then, should you consider “How does this business serve my Personal Strategic Plan?”

- Assuming the business indeed serves your needs, then “What outcomes does this business need right now to help me satisfy my personal needs?”

Protect the Asset1

As you work on articulating your personal needs, you will surely adequately account for your family and others, and for the financial requirements from the business. But what about you? In a personal financial services company, the most important assets are the people. As a business owner, that’s you. And in a small business, you’re most, if not all the team.

In strategic planning, it’s essential to find your biggest points of leverage: areas that with attention will yield progress over and above the time commitment, and that will compound over time. Your energy and cognitive performance are the biggest leverage you have and they are mostly under your control. Your ability to optimize how you perform day in and day out: think, plan, focus, persevere, endure, and achieve, is almost completely dependent on you. You are a walking chemical cocktail and the quality of those activities are driven by how the chemicals flow or don’t flow based on what you do or don’t do on a daily basis.

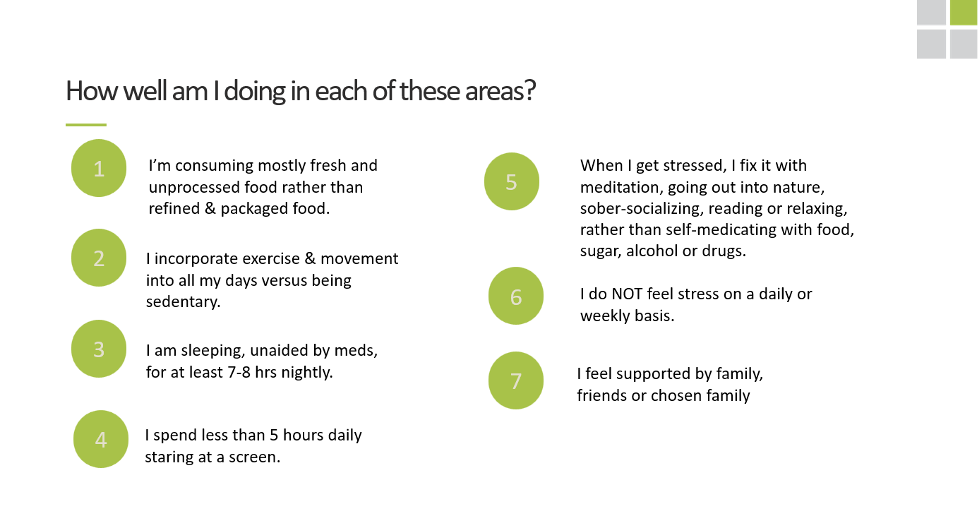

Make a commitment to assess how well you are protecting the Asset. Here’s a way to get started, inspired by the book State Change by Dr. Robin Berzin. Each of these items represents an area that greatly affects the chemicals that are activated or prevented from activation, governing your mood, your energy, and your cognitive performance. Give yourself a rating in each of the following areas and start making a plan to improve those areas you know are lacking.

Be especially thoughtful about items 6 and 7. Failing one or both of those will tend to trump good results in the others.

Be especially thoughtful about items 6 and 7. Failing one or both of those will tend to trump good results in the others.

Sitting down to do an honest assessment of your self-care is the tip of the iceberg. Addressing any one of these, never mind multiple areas, is a serious endeavor requiring motivation, planning, discipline, strategies and tactics – and it will take time. But the help is out there and if you don’t feel equipped to handle these on your own, follow Qii Consulting on LinkedIn and we promise you’ll be exposed to the latest relevant knowledge, resources and experts to help you put yourself first in your strategic planning.

1. “Protect the Asset” is all about your wellness journey for a successful life. Thank you to Bridget Grimes of WealthChoice for articulating the business case for self-care.